Decide where capital wins.

The complete CAPEX decision platform — 5 modules, one truth.

Bank‑grade DCF + Real Options, scenarios, portfolio and risk — auditable, explainable, investment‑committee ready.

- 90% faster decisions

- 30% more NPV

- 100% traceable

Five specialized modules, one integrated platform:

See CapexEdge in Action

Professional-grade investment analysis platform trusted by leading energy companies

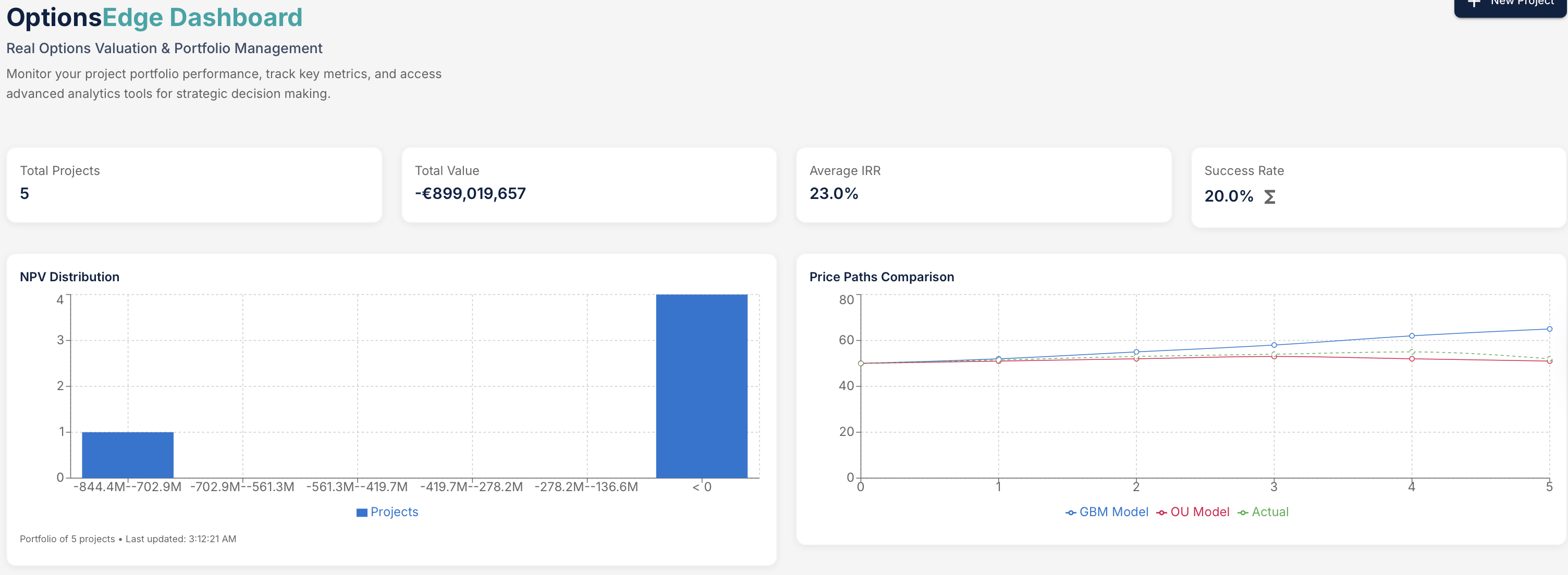

Real-time portfolio dashboard with NPV distribution and performance metrics

Click image to view full screen

The €10 Billion Problem

Investment Committees Are Broken

They spend 3 weeks on decisions that should take 3 hours. They leave 30% of value on the table because Excel can't do real options. They can't optimize portfolios, only rank projects.

We Built the Operating System for CAPEX Decisions

Upload your Excel. Get bank-ready analysis in 2 days. Every calculation traceable. Every scenario versioned. Every option valued. Every portfolio optimized.

Modular by design

Excel-exact DCF foundation

Excel models break when you change the timeline

Bank-grade DCF with Excel parity.

Find 15-30% hidden value

Excel can't value American options properly

Real options on top of DCF.

Version control for assumptions

Version_final_v2_FINAL.xlsx chaos

Consistent scenario sets.

Optimize, don't rank

Cherry-picking leaves 300bps on the table

Optimize under constraints.

Bank-ready sensitivities

Manual sensitivities take days, miss correlations

Sensitivities & Monte‑Carlo.

Beyond Options — The Complete Decision OS

The real value isn't just option pricing — it's making capital deployment faster, safer, and better governed.

Trusted Data & Lineage

Governed data layer with versioned scenario packs, Excel parity, approvals.

↓ 50-70% cycle time to memos

Portfolio Optimization

Select projects/timings subject to capex, grid, ESG, VaR/CVaR constraints.

↑ 100-300bps portfolio IRR

Deal-Structuring Copilot

Suggest optimal PPA/tolling clauses, simulate bankability vs upside.

↑ NPV per deal, better terms

Treasury Integration

Roll project exposures into hedge policy, dynamic limits, credit monitoring.

↓ Earnings volatility

Model Risk Management

SR11-7 model inventory, validation, seeds/snapshots, IFRS/GAAP packs.

Zero audit issues

Digital Twin Linkage

Couple capex models with dispatch/weather, update options from ops reality.

↓ Build vs dispatch gap

Value Tracking

Track realized vs plan, recalibrate volatility, feed back into pipeline.

↑ Forecast accuracy

Workflow & Collaboration

RACI workflows, Slack/Teams apps, templates, audit trails, approvals.

↓ Handover errors

Explainability & Training

Hover-trace proofs, Excel exports, option credit policy, micro-courses.

↑ Adoption & trust

Enterprise-grade security with SOC2, GDPR, EU data residency, SSO/SCIM, and customer-managed keys.

1) Structure

Templates & Excel import. Solid DCF baseline incl. financing & tax.

2) Explore

Scenarios, risk, and real options to capture managerial flexibility.

3) Decide

Prioritize projects & portfolios. Generate bank‑ready memos.