PortfolioEdge

Optimize capital under real constraints.

Choose the timing and mix under capex, grid, ESG, and risk limits to lift portfolio IRR by 100–300 bps.

At a glance

MILP-based optimization

Budget, timing, dependencies, resources handled properly

Risk & ESG constraints

VaR/CVaR limits, emissions caps, technology requirements

Scenario-aware

Optimize on Base, robust-check on Downside

Who it's for

Holdcos, funds, and corporates allocating scarce capital across many assets with real-world constraints.

What you can do in 45 minutes

- Load your project pipeline with NPVs and constraints

- Set budget envelopes and risk limits

- Generate optimal selection and timing

- Export board-ready allocation plan

Key capabilities

Budget & phasing

Annual envelopes, ramp-rates, multi-year schedules

Risk controls

Max portfolio VaR/CVaR, concentration limits

ESG & strategy

Emission budgets, technology mix requirements

Dependencies

Project sequencing and mutual exclusions

Scenario-robust

Solve on Base; ensure feasible on Downside

What-ifs

Test constraint sensitivity instantly

How it works

Load

Import candidate projects with metrics

Configure

Set constraints & objectives

Optimize

MILP solver finds best portfolio

Export

Schedule, curves, and bank pack

PortfolioEdge in Action

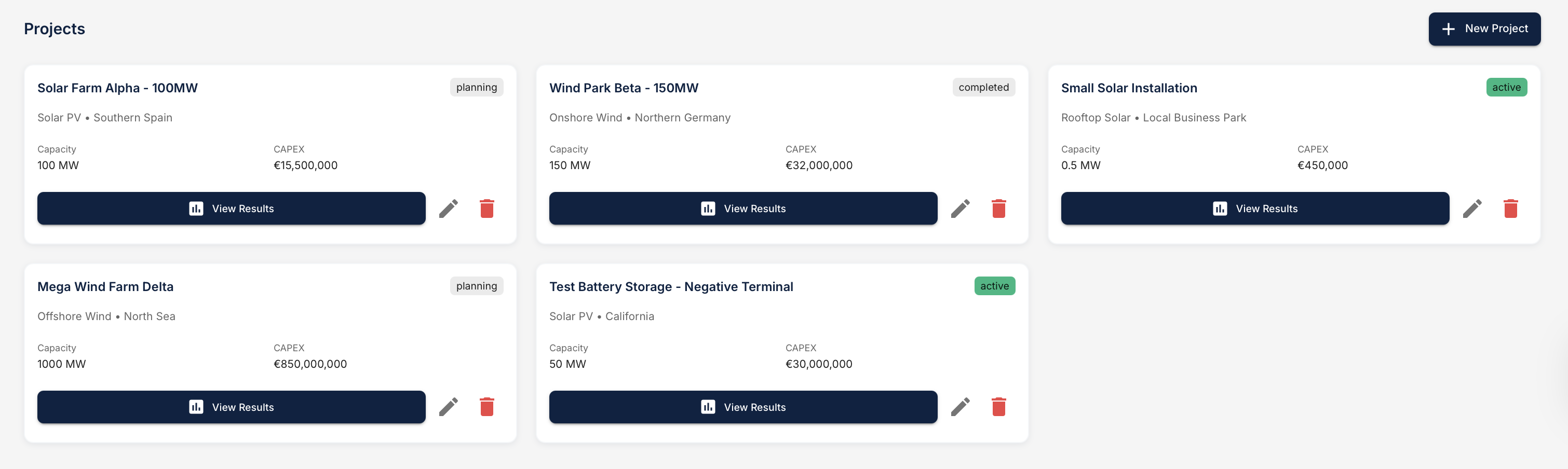

Portfolio overview and optimization dashboard

Portfolio optimization with project selection and constraint management

Click image to view full screen

Outputs you'll export

- Optimal project selection

- CAPEX deployment schedule

- Efficient frontier chart

- Shadow prices

- Portfolio KPIs

Governance & Security

Versioned packs, approvers, immutable logs; SSO/SAML; SOC2-aligned controls; GDPR & DPA available.

FAQs

How fast is optimization?

Seconds for 100 projects, minutes for 1000+

Can I force projects in?

Yes, pre-select mandatory projects

What about correlations?

Full correlation matrix support

Ready to optimize your portfolio?

Join leading utilities and funds already using PortfolioEdge